Investment Rationale

Emerging market growth should drive top line growth

- PMI generated 33% of its revenue from emerging markets last year

- The company should continue to benefit from price increases in emerging markets

- Management believes that cigarette prices are still very low by international standards in emerging markets and have a lot of room to increase (which is confirmed in the table below comparing prices of 20 pack of Marlboro to Big Macs)

Sources: Economist, JPM

- Furthermore, PMI should benefit from stronger emerging market economic growth that should drive per capita income growth and cigarette volume growth

- PMI is also well positioned to gain market share in emerging markets based on the strong brand name of its premium Marlboro brand, which is very popular with younger smokers

Strong pricing power

- PMI is the price leader in markets that contribute 70% of its operating income according to industry experts

- The company should be able to raise prices in all markets, which should allow the company to generate mid single digit revenue growth

Revenue growth from acquisitions

- Following the spin-off from Altria, management was interested in increasing its M&A activity

- PMI acquired Rothmans, Canada’s 2nd largest tobacco producer, for $1.9 billion last year

- This acquisition gave the company control of a third of Canada's cigarette market and the leading share of its fast-growing discount category

- PMI acquired Swedish Match’s South African operations for approximately $220 million in July 2009

- This acquisition gave the company control of roughly a third of South Africa’s tobacco market

- Management will continue to explore accretive acquisitions that can expand its presence in key international markets

Beneficiary of weaker U.S. dollar

- Since PMI generates all of its revenue outside of the U.S., its revenue growth benefits from U.S. dollar weakness

- Many currency experts believe that the U.S. dollar will continue to depreciate relative to international currencies over the next several years based on the U.S.’s record budget deficits and higher rate of money printing

Cost cutting opportunities

- PMI initiated a plan to cut $1.5 billion in costs from 2008 to 2010 based on moving production facilities to European plants, eliminating lower margin product lines and reducing SG&A costs by maximizing efficiency of shared services and reducing back office operations

- These cost cuts should be partially offset by cost increases of tobacco leaf procurement and higher direct manufacturing costs that should total around $500 million

Strong free cash flow generation

- PMI generated $6.8 billion in free cash flow in 2008

- The company plans to continue to use its FCF to buy back shares (the company has over $3.5 billion remaining on its current share repurchase plan) and to fund its 65% dividend payout ratio

- At the end of the third quarter of 2009, the company’s net debt / ebitda ratio was 1.2x, which is very conservative for a leading consumer staples company

China optionality

- The Chinese tobacco market is currently predominantly controlled by China National Tobacco Corporation, the Chinese state-run monopoly

- China’s estimated annual cigarette sales are $100 billion vs. $70 billion in the U.S.

- PMI currently sells Marlboro cigarettes in China through a licensing agreement, but it does not control a very large percentage of the market

- If the Chinese tobacco market opened up more over the next five years, PMI’s volume growth would benefit

Concerns and Risks

Market share losses in Europe

- PMI lost 1%-2% market share in the EU over the last two years (bringing its total share to ~39%) due to down trading (which has been increasing with higher unemployment levels) and aggressive price competition in select markets from British American Tobacco

- As a result of these factors, PMI will probably not raise prices as aggressively in Europe over the next several years to help stabilize its market share

Susceptible to price wars

- PMI lost about 4% of its EBIT in 2006 due to a price war in Spain according to industry experts

- Gallaher and Altadis were former competitors that were most aggressive in discounting prices in the EU and Eastern Europe to gain share

- Both companies have been acquired, which should reduce the risk of a future price war

- However, British American Tobacco remains aggressive in select markets

Tax increases

- PMI has limited control of tobacco tax increases in international countries that can come in the form of excise taxes, sales taxes and import duties

- Taxes can impact PMI’s price competitiveness relative to local brands and can result in down trading

- According to management, the excise tax environment has generally become fairer and more reasonable over the last five years

Valuation

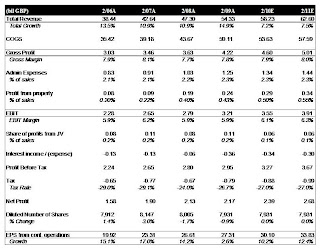

Historical Valuation Analysis

- PMI’s stock has only traded as a separate entity for under two years, which limits the usefulness of historical valuation analysis

- On an EV/EBITDA basis and on a forward P/E basis, PMI is trading close to the middle of its historical trading ranges

Source: Capital IQ

Source: Capital IQ

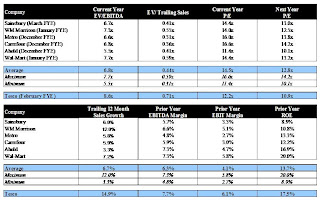

Comparable Valuation Analysis

- PMI’s stock is trading in line with its international peers based on EV / next year EBITDA multiples and a 10% premium to its international peers based on forward P/E multiples

Source: Bloomberg

Company Description

Philip Morris International was spun off from Altria in March 2008 to protect its international earnings from U.S. litigation. Cigarette related litigation is rare overseas due to a higher tolerance for smoking.

The company is one of the largest international manufacturers and sellers of cigarettes and other tobacco products. It is the market leader in Europe, Eastern Europe, Turkey, Mexico, Argentina and Indonesia.

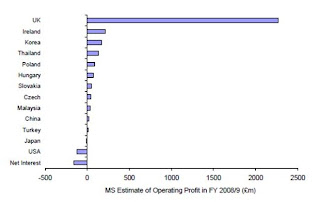

PMI generated 45%, 35% and 20% of operating profit from the European Union, emerging markets and Asia respectively last year.

Geographic EBIT Mix in 2008

PMI’s portfolio comprises international and local brands. Its primary international brands include Marlboro, Merit, Parliament, Virginia Slims, L&M and Chesterfield. Marlboro represented 36% of PMI’s volume sales in 2008 and the Marlboro brand has helped PMI gain control of 53% share of the international premium cigarette market.

PMI purchases tobacco leaf of various grades throughout the world, primarily through independent tobacco dealers. Its largest sources of supply are the U.S., Brazil, Indonesia, Turkey, Greece and Argentina. The company also contracts directly with farmers in several countries including the U.S., Argentina, Mexico, Indonesia, Ecuador, Dominican Republic, Poland, Colombia and Portugal.

Volume and Pricing Trends

Sources: Citi Research (10/23/09), PMI, CIRA

PMI’s volume trends deteriorated in the third quarter of 2009 on the back of very challenging year-over-year comps. The company was able to increase its average prices significantly, particularly in emerging markets, to generate respectable top line growth of 4.1% in the third quarter.

Marlboro Retail Price, Tax and Net Proceeds in Select Countries

Source: Citi Research (10/23/09)

Tobacco Industry Consolidation

There has been significant consolidation in the tobacco sector in recent years, including Japan Tobacco’s acquisition of Gallaher, Imperial’s purchase of Altadis, PMI’s acquisition of Rothmans, and British American’s purchase of Tekel. The following table highlights major M&A deals in recent years. Consolidation should result in less price competition, which favors the major players.

Source: JPM Research

Competition

PMI’s major international tobacco competitors include British American Tobacco, Japan Tobacco and Imperial Tobacco. PMI also competes against several regional and local tobacco companies as well as government-owned tobacco companies, principally in China, Egypt, Thailand, Taiwan, Vietnam and Algeria.

PMI controlled 16% of the international tobacco market and 26% of the international tobacco market excluding China in 2008.

Source: PMI Presentation