Exxon’s stock price target is $86 based on applying a 15x multiple to its 2010 estimated earnings. A 15x target multiple is appropriate based on its ability to deliver double-digit earnings growth over the next several years and is in-line with its historical average.

Investment Rationale

- Largest reserves of oil majors

- Exxon had proved crude oil and natural gas reserves of about 23 billion barrels of oil equivalent (boe) at the end of 2009, enough to last 15 years at current production levels

- The company also controls a 70% stake in Imperial Oil, one of Canada’s largest oil companies that holds 465,000 acres of tar sand leases in Alberta and has 2.4 billion barrels of proved reserves

- In addition, Exxon had a total resource base of 75 billion boe, which the company will develop opportunistically

- Production growth of 2%-3% annually until 2013

- During 2009, Exxon started up eight major projects, which are expected to add 400,000 net barrels per day (bpd) of production in 2010

- The company also plans to start production on 12 other major projects in Qatar, Nigeria and Canada between 2010 and 2012

- Qatar has rapidly emerged as the world’s largest producer of liquefied natural gas (LNG)

- Exxon is developing seven facilities, or “trains” in Qatar that will convert natural gas reserves into liquefied natural gas that can be shipped worldwide for the highest prices

- When all seven hit peak output, they will produce the equivalent of over one million barrels of crude per day of which Exxon’s share is approximately 40%

- Exxon expects its new projects to increase production by 1.5 million barrels of oil (boe) equivalent per day by 2015

- Its new production growth is expected to exceed normal field declines over the next three years

- Beneficiary of higher oil prices

- Over the next decade, oil prices should increase based on higher demand in emerging markets and a challenging supply environment in which it will be difficult to increase production meaningfully over 85 million bpd level according to industry experts

- Best return on equity ratio in industry

- Exxon’s return on equity is 21%, the highest of its energy peers

- The company evaluates projects from around the world against each another and only those with the most attractive returns receive funding

- Historically, Exxon has excelled at adding low-cost reserves at opportune times

- Its purchase of XTO significantly increases its exposure to unconventional natural gas at a time when natural gas prices are very depressed, which exemplifies its long-term strategy

- Strong free cash flow generation

- From 2007 until 2009, Exxon generated average free cash flow of $27.7 billion

- The company plans to continue to use its free cash flow to pay for its share repurchase program of $3 billion per quarter and to fund its dividend

- Exxon reduced its shares outstanding by 26% from 2005 until 2009 and increased its dividend by 57% in the same time period

Concerns and Risks

- Risk of lower returns on new oil output

- New oil discoveries are getting tougher to find and are more expensive to develop

- Many of the exciting new oil fields are controlled by state-owned companies that offer less profit to production partners

- Some industry experts believe that Exxon’s return on capital will be lower than in the past as a result of these factors

- Refining industry overcapacity

- Earnings in the refining segment peaked at $9.6 billion in 2007 and declined to $1.8 billion in 2009 due to lower refining margins caused by combination of weak demand for gasoline and heating oil, as well as excess global refining capacity

- The worldwide glut in refining capacity should continue to pressure Exxon’s refining margins over the next several years

- Unlike some of its peers, the company has no plans to sell any of its refineries

- Cyclical chemicals business

- Earnings in the chemicals segment also declined from $4.6 billion in 2007 to $2.3 billion in 2009 due to lower sales volumes and margins caused by the global economic downturn

- In the next year, chemical earnings should rebound with stronger global economic growth

- Political risk

- Exxon operates in many high-risk countries, where its contracts are at risk of being altered whimsically by government officials

Valuation

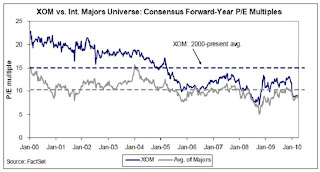

Historical Forward P/E

- On a forward P/E basis, Exxon is trading at close to the trough of its historical trading range in the past decade

Source: Raymond James

Historical Dividend Yield

- Exxon’s dividend yield of 3% is the highest it has been since the stock market crash in 2002

Source: Bloomberg

NAV Analysis

- Some analysts believe that Net Asset Value (NAV) estimates better capture Exxon’s fair value since NAV estimates incorporate cash flows from future projects that are discounted to present value

- On an estimated NAV basis, Exxon is trading at a 33% discount to fair value

Comparable Valuation Analysis

- Exxon stock’s historical premium to its peers has diminished over the past decade, providing an opportunity to buy a best-in-class energy company at an attractive valuation

Source: Raymond James

- Exxon is currently trading at a 12% premium to its peers based on next year EV/EBITDA multiples and a 16% premium to its peers based on next year P/E multiples; in the past, Exxon’s stock has traded at larger premiums

Sources: Bloomberg (7/12/10), Thomson

Price Target

Exxon’s stock price target is $86 based on applying a 15x multiple to its 2010 estimated earnings. A 15x target multiple is appropriate based on its ability to deliver double-digit earnings growth over the next several years and is in-line with its historical average.

Company Description

Exxon Mobil is the world's largest publicly traded integrated oil company with operations in over 200 countries. In 2009, 81% of the company’s operating earnings were generated from upstream exploration and production activities, 8% from downstream refining and marketing activities and 11% from chemicals.

In the upstream segment, Exxon had proved crude oil and natural gas reserves of about 23 billion barrels of oil equivalent (boe) at the end of 2009. The proved reserves are approximately divided evenly between crude oil and natural gas, and are geographically diversified with 38% located in Asia and the Middle East, 17% in the U.S., 14% in Europe and 14% in Canada and South America. The company also owns 70% of Imperial Oil, one of Canada’s largest oil companies that holds 465,000 acres of tar sand leases in Alberta and has 2.4 billion barrels of proved reserves.

Source: Exxon Mobil

In 2009, Exxon produced 3.9 million boe/day, with 62% derived from oil and 38% from natural gas. Overall production increased 1.6%, primarily due to new projects in Qatar, Africa and North America. Approximately 20% of Exxon's global oil output is tied to production sharing contracts (PSC), with much of the company's PSC oil being produced in Africa. According to management, Exxon has replaced more than 100% of its production in each of the past 16 years.

2009 Geographic Production Mix

Source: Exxon Mobil

Exxon increased its exploration acreage by over 40% since 2003, bringing its total acreage to 72 million acres. Key exploration areas include acreage in Canada’s Horn River Basin Devonian shale gas play, additional positions in the Marcellus shale gas play and licenses in Norway, Germany, Poland, Turkey, Vietnam and Indonesia.

In the downstream segment, Exxon is the largest refiner and marketer of petroleum products in the world with 6.3 billion barrels per day of refining capacity and 27,000 service stations. The company’s market share (measured by percentage of total capacity) was approximately 7% globally (#1) and 11% domestically (#3, slightly trailing Valero and Conoco Phillips). Exxon’s refining capacity is geographically diversified with 42% in the Americas, 31% in Europe, Africa and the Middle East, and 27% in Asia.

Exxon is the only major integrated oil company that has maintained a significant commitment to its chemicals business. In the commodity petrochemicals market, Exxon is #1 in paraxylene and #2 in olefins. In the specialty market, the company is #1 in butyl polymers, fluids, plasticizers, synthetics, oriented polypropylene films, and adhesive polymers, and #2 in specialty elastomers and petroleum additives. The commodity petrochemicals market is intensely cyclical, while the specialty market generates more stable profits. Its chemical business is 90% integrated with the rest of its business divisions, especially in refining where the two divisions share plants and the refineries supply feedstock to the chemical unit.

Exxon closed the acquisition of XTO Energy, the largest producer of U.S. natural gas, in June 2010. Following the acquisition, Exxon’s percentage of overall production coming from U.S. natural gas increased from 5% to 15%. Management believes that demand for natural gas will grow as U.S. carbon legislation encourages power producers to build gas rather than coal-fired plants. The company also expects natural gas demand to grow 1.8% per year through 2030, exceeding oil demand growth of 0.8% per year over the next twenty years.

Capital Spending by Segment

Source: Exxon Mobil

Exxon plans to spend between $25 billion to $30 billion per year on capital expenditures through 2014, with the majority focused on its upstream segment. Exxon’s management has a long-term capital spending strategy that is essentially fixed regardless of short-term commodity price volatility.

Global Oil Outlook

Global consumption of oil decreased since 2007 due to slower global economic growth and weaker manufacturing activity. Oil consumption declined the most in the U.S. and in Europe. Over the next decade, global demand for oil should grow, driven by incremental demand from emerging markets, especially China, India and Brazil. Following World War II, Japan’s per capita oil demand increased significantly driven by rapid urbanization and higher living standards. Oil demand should grow rapidly in emerging markets based on similar dynamics.

On the supply side, global oil production has decreased slightly since 2005. In 2009, OPEC production fell by 1.9 million barrels per day (bpd). Of the largest 21 oil fields in the world, at least 9 are in decline. According to some industry experts, one Middle Eastern country that might be able to increase production is Iraq if the country becomes more stable over time. Non-OPEC supply has not been growing rapidly and is often found in “harder-to-reach” areas that are costlier to develop. In 2009, non-OPEC production only grew 0.2 million bpd.

Sources: EIA, BP

Over the next decade, oil prices should increase based on higher demand in emerging markets and a challenging supply environment in which it will be difficult to increase production meaningfully according to industry experts. In the next year, oil prices should be supported by global economic growth exceeding 4% and a six month deepwater drilling moratorium in the Gulf of Mexico.

Source: Bloomberg

U.S. Natural Gas Outlook

U.S. consumption of natural gas has remained fairly steady over the last decade based partially on stronger than expected coal demand for electric generation and excessive volatility associated with natural gas prices that has discouraged some power producers from switching to natural gas. In 2009, consumption declined 1.8% due to weaker industrial demand for natural gas. Consumption should rebound with stronger economic growth this year.

On the supply side, natural gas withdrawals from wells increased 1.6% in 2009. Cash flow requirements and potential damage to wells forced producers to continue to withdraw gas from wells. Increased LNG imports and development of gas production from shale reservoirs are expected to add to future supply this year.

Source: EIA

U.S. natural gas prices should remain subdued in the next year due to the high number of working natural gas rigs, which rose 43% from last year, and high U.S. storage levels, which were 12% higher in July 2010 than their five year average. Some industry experts expect a more active hurricane season in 2010, which might disrupt production in the short term and drive natural gas prices higher. Longer-term, natural gas prices are poised to benefit from new climate regulations and its reputation as a source of clean energy. Historically, oil has traded at a ratio of 9:1 relative to natural gas. The current ratio of 17:1 suggests that more energy consumers will use natural gas in the future to lower their cost base, which should help drive natural gas prices higher.

Source: Bloomberg

Full Disclosure

Recommended to Bolter and Company, a NY-based investment management firm, on July 13, 2010

Family accounts that I manage currently own XOM stock